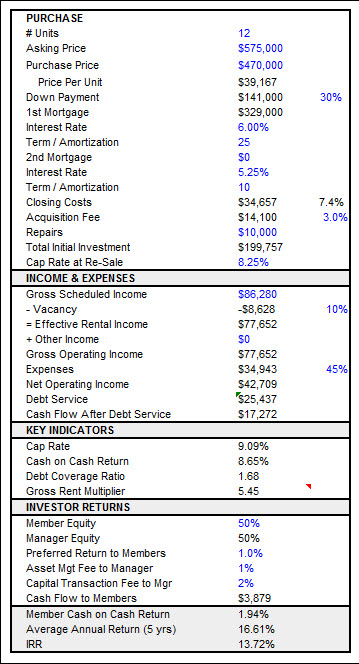

16.61%: Investor's Estimated Annual ROI (not including additional tax benefits)

$200,000: Total Initial Investment Required (may be split between investors)

$200,000: Total Initial Investment Required (may be split between investors)

|

Property:

|

Area:

|

Strategy:

|

Deal Details:

Asking price: $575,000

NOI per seller: $47,800

CAP rate: 8.3

Actual NOI: $42,709

Offer based on 10 CAP: $427,090

Negotiated purchase price: $470,000 (based on significant upside)

Years 1 and 2 show lower cash flow as rents are increased.

Years 3, 4 and 5 have significantly higher cash flow.

Total estimated ROI for partners is 83.03%, for an estimated annual ROI of 16.61%.

Asking price: $575,000

NOI per seller: $47,800

CAP rate: 8.3

Actual NOI: $42,709

Offer based on 10 CAP: $427,090

Negotiated purchase price: $470,000 (based on significant upside)

Years 1 and 2 show lower cash flow as rents are increased.

Years 3, 4 and 5 have significantly higher cash flow.

Total estimated ROI for partners is 83.03%, for an estimated annual ROI of 16.61%.